-

Posts

3512 -

Joined

-

Last visited

Everything posted by willstrickland

-

We will solve the obesity issue soon when gas goes to $7/gal and everybody is walking or pedaling.

-

I'll second Sobo's questions. Count me as another disgruntled engineer. And looks like I'm not the only one tired of slavin' for the man. My credit history SHOULD be tops (although I've never requested score/history), and as of Dec I will be completely debt free having paid off the outstanding creditcard and student loans in the last year. The initial cash investment shouldn't be an obstacle for me.

-

Terminal Gravity IPA Lucky Lab Stumptown Porter on nitro Old Rasputin Russian Imperial Stout

-

Curious if any of you folks are currently, or have been, franchisees? Would like to get some insight from an experienced owner/operator, or from those who considered and declined the franchise path.

-

Airplane pulling the banner over Seattle right now

willstrickland replied to olyclimber's topic in Spray

Umm, yeah. Because as we know, the summer box-office smash, which won the Academy Award for best picture in 1789 was.... -

Airplane pulling the banner over Seattle right now

willstrickland replied to olyclimber's topic in Spray

You'll enjoy this one, spotted over the Superbowl in Houston And this is always a nice sentiment to see coming from the great state of Washington: -

Join the club missy. At least you have climbing options after work or on the weekends. Play some solitaire or something, start a rumour about a coworker, dance naked around the cubicle.

-

It's kinda on the underneath side, facing the wall. Just look about a foot off the ground, on the wall side of the boulder and you'll see it. EDIT: Looks like I was beaten to the punch.

-

Find a bro-brah with a Mac. Firewire and a DV editing suite on any recent Mac AFAIK.

-

Don't worry, Wilford Brimley Jr, aka John "Batshit Crazy" Bolton, affectionately known by his nick-name The Boss From Hell, is headed to the UN to represent our great nation and to straighten that organization right out. And I do mean "right" out. I'm sure the rest of the world will take him seriously, knowing that he couldn't even get through a GOP controlled Senate approval process and had to be slipped in the back way as a recess appointment (Mehlman probably knows a little something about slipping in the back way...not that there's anything wrong with that, mind you...if that's your thing.) Doesn't it seem a little two-faced to you GOP stalwarts that your party chairman is a gay man that frankly looks like a foreigner, who actively supports and conducts campaigns with homophobia and xenophobia as central themes? Just askin'.

-

Not for months now. Solstice is next week. Sunset is around midnight, sunrise about 3:30am or so. Doesn't get dark though, sun never gets very far below the horizon just kind of skims below it for a bit, sort of a long sunset transitioning into sunrise. Messes up my sleep patterns but it's great for fishing. Our minor league baseball team plays a midnight game with no lights around this time every year.

-

Give global warming a few more years. It's close to 80 right now.

-

Well, I am more northwest than any of you foos. More north AND more west...by thousands of miles. but Layton ain't a geography major, hence his version of PNW ends in BC. So I didn't answer the poll.

-

Nothin' but fly fishing. I am not a climber anymore, closest I get to climbing these days is ascending the two flights to my apt.

-

Jay_B, you were discussing the housing bubble issue earlier, and I see you quoted Schiller above. You might look into his recent writings on the housing bubble if you've yet to do so. He is firmly in the unsustainable bubble camp. And Friedman sucks. Worst mixed up metaphors ever. Here's Friedman's style: First talk about yourself, toss in some anecdotes, reveal your brilliant conclusion in a strained metaphor without realizing that the brilliant conclusion is a "no shit sherlock" to everyone else. Let me try to imitate: Last year my wife and I visited Alaska where we met my good friend the famous scholar Dr. Eskie Mo. Over king crab legs and halibut at his 7,000 sq ft log home, Dr. Mo said to me "Thomas, everything is changing. The arctic is warming and it's heat-sink abilities are diminishing rapidly and threatening native subsistence lifestyles." Then it hit me, my god he's telling me that our arctic is an overflowing kitchen sink, with too much heat! My next book, titled "Drano and the Eskimo" examines this revelation in depth.

-

Superfly wires. Agree with trogdor, better than neutrinos.

-

Werd, I stream it up here. One of the better stations in the nation fer sure yah.

-

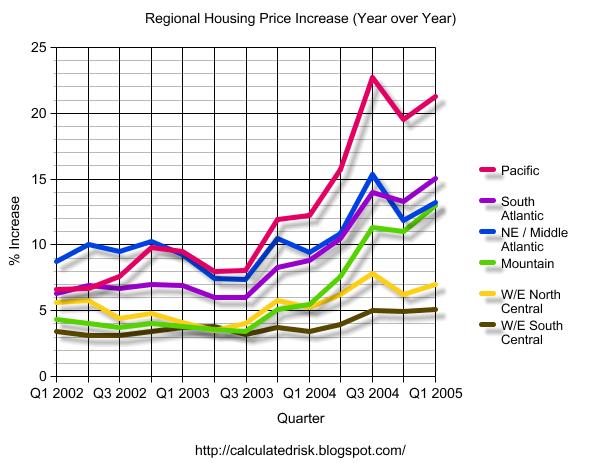

BTW, bankruptcy filings hit an all time high last month. Foreclosures are picking up substaintially. The quality of credit (not to mention the volume) is absurd. The banks don't care about the credit quality, they sell the loans to Fannie anyway who packages them and sells the MBSs. Add in the other derivatives and you have a highly leveraged credit system with horrendous underlying quality. Anyone have an idea of the reserve banks are carrying as a % of loans? Used to be around 10% or so for a 10:1 leverage, if my numbers are correct. Today? Ohh try 0.93%. In other words, you go deposit a dollar into the bank, they loan over $100 off that $1. More? Ok. 40% of the jobs created since the dot-bomb collapse are residential housing related...construction workers, mortgage brokers, real estate agents, etc. When the sector cools and we loose the economic driver of the latest expansion, what happens? I don't argue that homes are a great investment. Clearly they are. But I can't see any reasonable case that the current trend is sustainable. At some point, you run out of speculators and price the avg person out of a home. In SoCal the median house price is only affordable by 10% of the population...that is not sustainable. Asset class price rises above and beyond GDP growth+inflation are not sustainable. When 68% of families own their home, who are you going to keep selling to? As Dru points out, prices will rise as long as everyone chases real estate as the latest "no brainer" investment. And optimism in a sector is always highest at the blow-off top. Once everyone is "in", prices must fall. With housing, the reaction is typically first seen in longer turnover times (i.e. avg time a home is on the market). But houses act diffently than other assets. As the prices drop, people tend to take their home off the market, thus restricting supply and stabalizing prices. Japan had stagnant property values for a decade. So did parts of Texas after the mid-80s housing bust. SoCal took only 3 or 4 years to recover after a 10% haircut in the early 90s.

-

Here ya go, Fed Funds rate (this is what the Greenspan is actually manipulating when they raise/cut rates).

-

Yeah, I have rates might take min to find them (on home computer, I'll have to source it elsewhere). Stefan, you are way off the mark bro. The housing sales/starts etc are WAY WAY above pop. growth levels in the "hot" markets.